This Event already finished.

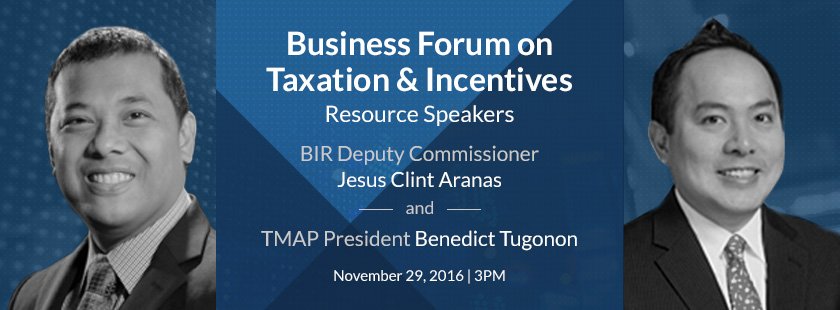

ICCP Business Forum on Taxation & Incentives

Event Overview

Join us on November 29 as we discuss the government’s planned new tax system, and know how it can impact you!

As a side event on November 29, the Israel Chamber of Commerce of the Philippines will also be holding a Business Forum to the new government's plan to create a simpler, fairer, and more efficient tax system and how that will impact companies operating in the Philippines, and those looking to establish operations in the country.

Providing their expert advice during the forum are Bureau of Internal Revenue (BIR) Deputy Commissioner Jesus Clint Aranas, who will discuss the government's tax reform program, and Tax Management Association of the Philippines (TMAP) President Benedict Tugonon who will discuss its expected impact on companies.

Where: Barossa and Tuscany, Tower Club Makati

When: November 29, 2016 at 3:00PM

Participation Rates

ICCP Member: Php 500

Non Member: Php 800

Walk-Ins: Php 1,000

Interested participants may also attend the 16th General Membership Meeting.

Participation Rates when attending both the 16th GMM Event and Business Forum Event

ICCP Member: Php 1,500

Non Member: Php 2,000

Walk In: Php 2,500

Speakers

Sponsorship

The Israel Chamber of Commerce of the Philippines (ICCP) would like to invite interested companies to partner with us for the upcoming 16th General Membership Meeting and Business Forum on Taxation and Incentives.

Sponsorship investment for the 16th GMM is valued at Php50, 000 and Php35, 000. Business Forum on Taxation and Incentives sponsorship is valued at Php25, 000 and Php15, 000. As our sponsor, you will be privileged to get these networking exposure and benefits.

With your continued support, this event will be a great success and more importantly, will foster growing relationship between Israel and the Philippines.

Click this link to download the sponsorship confirmation form.